A new mining revolution could redefine Brazil’s role in the global economy — not merely as a supplier of traditional raw materials, but as a central player in the transition towards a low-emission future. This is the message of a recent official paper issued by the Brazilian Ministry of Foreign Affairs, which highlights the country’s growing strategic importance in the global market for critical minerals. The goal is clear: to position Brazil as a reliable and sustainable supplier of key resources for the energy transition, while simultaneously attracting investment and promoting technologies that add value across the entire supply chain.

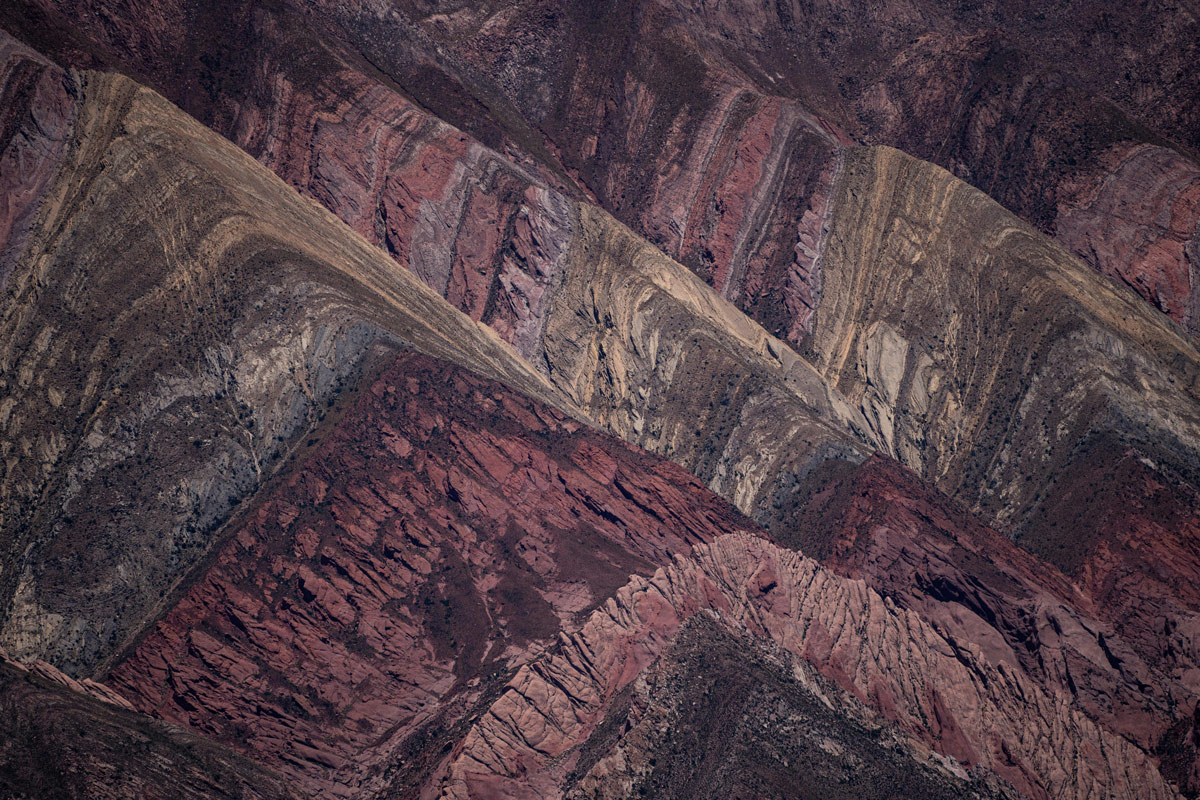

Brazil’s strategy rests on three main pillars: streamlining environmental permitting, attracting investment through targeted incentives, and promoting sustainable and lawful mining practices. At the core of the strategy is a classification of strategic minerals into three categories: those heavily reliant on imports (such as potassium, phosphate, and sulphur), those essential for advanced technologies (including lithium, rare earth elements, cobalt, and nickel), and those generating trade surpluses (such as iron, copper, and gold).

To maximise the value of these resources, a new ten-year geological mapping programme has been launched — currently, only 35% of the national territory has been explored — along with a USD 200 million public-private fund to support up to 20 small and medium-sized enterprises active in the sector. In parallel, the Brazilian innovation agency Finep and the National Development Bank (BNDES) have launched an EUR 820 million call for proposals to support projects related to batteries, photovoltaics, and magnets.

Despite its vast potential, Brazil currently exports almost all of its extracted rare earth elements to China for processing. To address this shortfall, Brazil is engaging in initiatives such as the Minerals Security Partnership, of which the EU is also a member. Among the most promising sites is the Serra Verde mine in Goiás, which has been operational since 2023. It employs low-impact ionic clay extraction to produce high-value magnetic rare earths such as neodymium, dysprosium, and yttrium. Should ongoing projects reach full capacity, Brazil could meet up to 10% of global demand by 2030.

Paradoxically, China remains Brazil’s main export destination: in the first quarter of 2025 alone, Brazilian copper exports to China rose by 180% (USD 331 million), while manganese and ferronickel exports increased by 310% and 253% respectively. Dependence on Beijing remains a key concern, and many Brazilian companies and institutions are working to strengthen national capacity for refining and processing.

Brazil is also the world’s largest importer of fertilisers — producing only 5 to 7 million tonnes annually against a domestic demand exceeding 45 million. Advanced negotiations are currently under way with the Russian firm Tenex for joint lithium exploitation. Further agreements with Russia also concern uranium. Brazil is the world’s seventh-largest producer and has launched a new national programme supported by updated geological mapping. The Caetité mine in Bahia produces 400 tonnes of uranium trioxide annually, part of which is enriched in Russia and subsequently reimported for use in nuclear power stations such as Angra dos Reis.

According to consultancy firm Deloitte, the full development of Brazil’s strategic mineral potential could add up to USD 6 billion to national GDP by 2030, and as much as USD 48 billion by 2050 — provided domestic refining capacity is significantly expanded. Pilot projects such as MagBras — focused on the production of magnets using neodymium, iron, and boron — mark an initial step towards building an integrated value chain from extraction to recycling. Over 28 companies are currently involved in this emerging ecosystem, including major players such as Stellantis, WEG, and Vale.

The overarching challenge is to build an innovative, sustainable, and strategically vital domestic mining industry capable of underpinning the future of green energy — one that leverages Brazil’s vast natural resources and is open to global partnerships. A challenge that could reshape not only Brazil’s economy, but also the geopolitical balance within global value chains.